Magazine, Past Issue

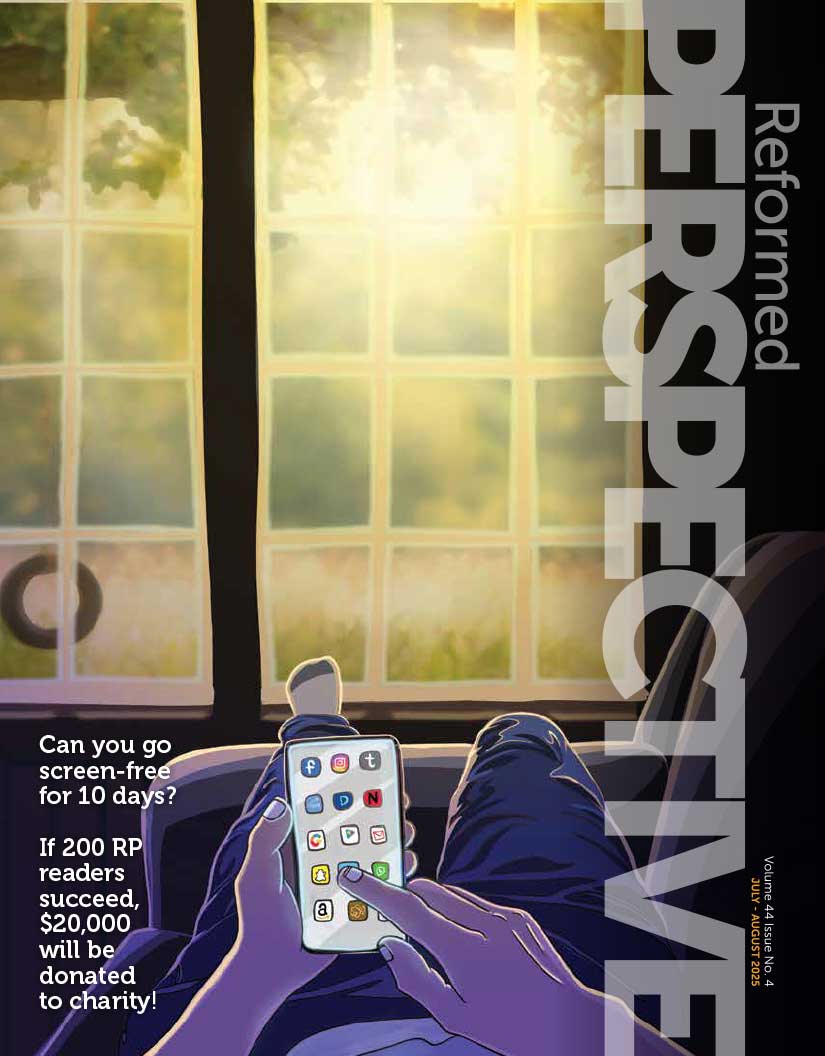

July/Aug 2025 issue

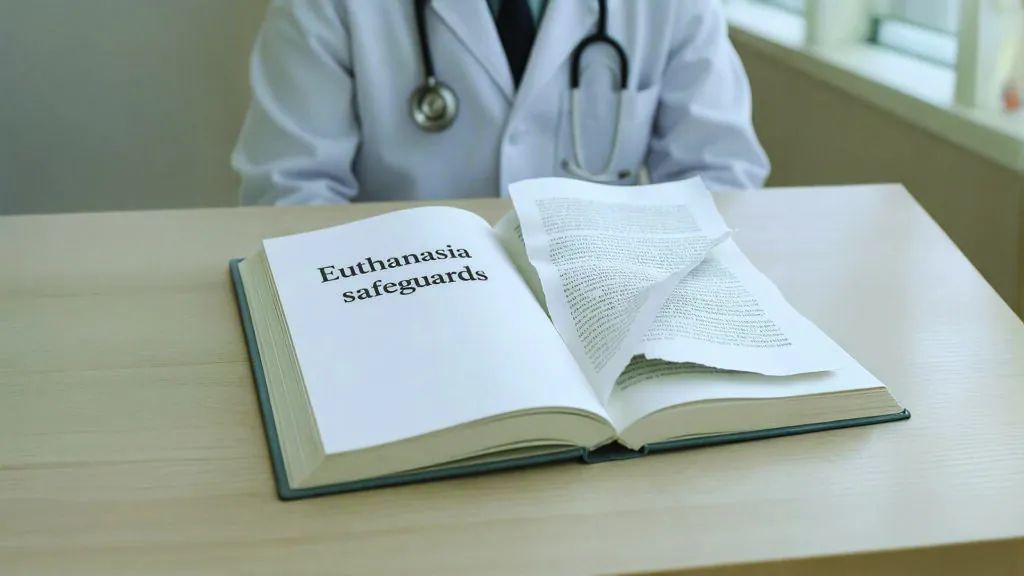

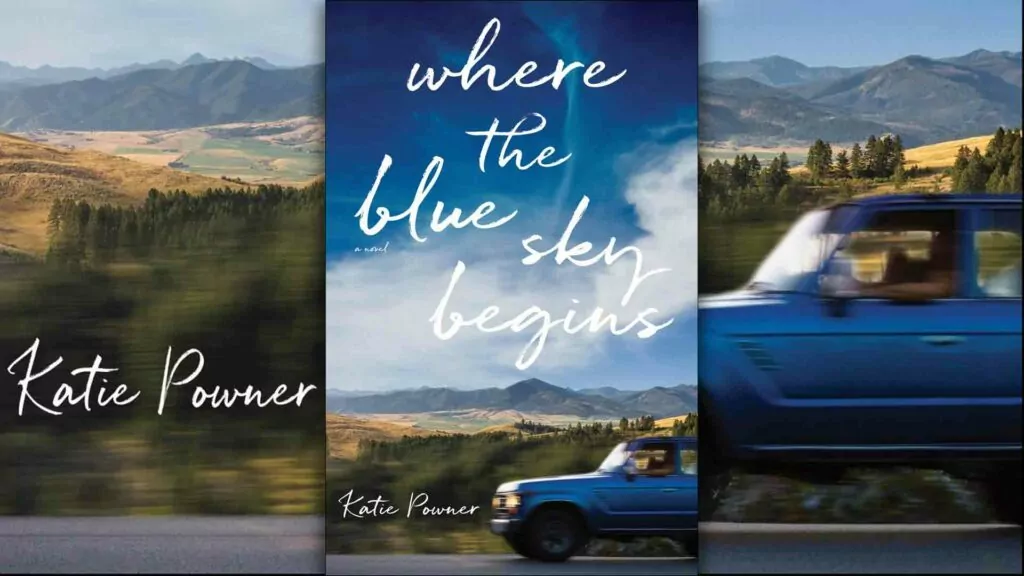

WHAT'S INSIDE: Are you still able: A nation-wide challenge to experience life without screens / Creation stewards in a logging town / Who do you want to be? RP's 10-day screen-fast challenge / We took the no screens challenge... and now we're changing our habits / What can I do anyways? 35 screen-alternative ideas / Is TikTok the ultimate contraception? / How to stay sane in an overstimulated age / Defeated by distraction / How to use AI like a Christian boss / Who speeches were they? On AI, and others, writing for us / The Way / Who is Mark Carney? / What if we said what we mean? - the political party edition / Am I lazy or just relaxing? What does Proverbs say? / Get out of the game: Christians need to steer clear of sports gambling / Man up: ARPA leaderboards and the call to courageous action / Christians don't pray / Our forever home / Calvin as a comic / The best comics for kids / Fun is something you make: 11 times for family road trips / Come and Explore: Mr. Morose goes to the doctor / Rachel VanEgmond is exploring God's General Revelation / 642 Canadian babies were born alive and left to die / 90 pro-life MPs elected to parliament / Ontario shows why euthanasia "safeguards" can't work / RP's coming to a church near you / and more!

Click the cover to view in your browser

or click here to download the PDF (8 mb)

News

Saturday Selections – June 28, 2025

The Franz Family and "Somewhere in glory"

If you liked the soundtrack to O Brother, Where Art Thou?, you'll love this but of bluegrass gospel...

Tim Challies with 4 good questions to ask your tech

- Why were you created?

- What is the problem to which you are the solution, and whose problem is it?

- What new problem will you bring?

- What are you doing to my heart?

Canada's Tax Freedom Day was June 21

June 21 was, according to the Fraser Institute, the day when – averaged across the country – Canadians stopped working for the government, and the money they earn for the rest of the year is the money they get to keep for their own households.

7 great questions to ask fellow believers

Want to get a deeper conversation started? Some of these could be great to pull out when you have a few couples over, or a group of friends.

How to get people to be friends with machines in 3 easy steps

The author of Digital Liturgies warns how AI "friendships" could be addictive in a way that's even beyond pornography.

Government-mandated small business destruction

With a stroke of a pen a government can destroy a business that the owner might have spent a lifetime building up. The destructive potential for government interference in the marketplace might have you thinking those in power would tread very lightly, using their fearsome powers only when they had to. But, as this latest incident highlights, that isn't always so.

A Quebec language law, if enforced, could cause all sorts of problems for board game stores in that province, since their niche games might not have any French on them at all, or not enough.

Today's Devotional

July 1 - Introduction to 1 John

This month we will be working through the epistle of First John. The main theme of this book is the Gospel of the Lord Jesus Christ and the fellowship with God that comes through Him. I am assuming that you are using this devotional because you are interested in deepening this fellowship. Whether you are seeking truth in Jesus for the first time or whether you have walked with God >

Today's Manna Podcast

A Trustworthy Saying: Jesus Came to Save Sinners: Sermon on the Mount

Serving #890 of Manna, prepared by G.H. VanPopta, is called "A Trustworthy Saying: Jesus Came to Save Sinners" (Sermon on the Mount) and is based on 1 Timothy 1:15.