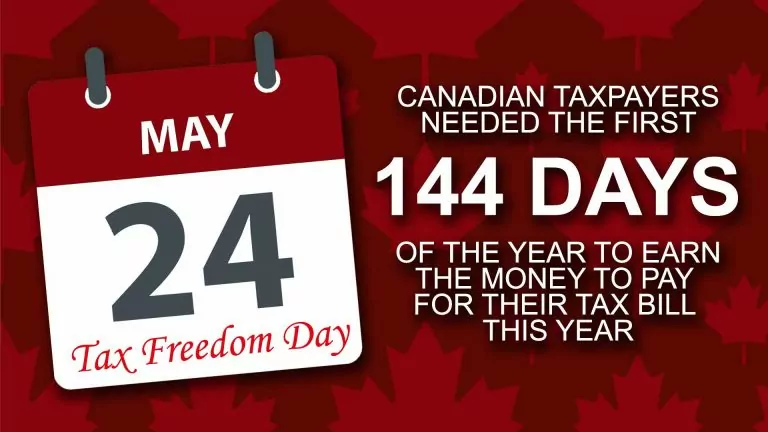

Each year the Fraser Institute, an economic think tank, calculates Canada’s “Tax Freedom Day.” If the average Canadian family’s earnings were to go just towards paying the taxes they owe to all three levels of government, this is the day they’d have paid it all off. In 2021, that was May 24.

This is accounting for not just your income taxes but all the taxes levied. So, also included are payroll taxes, health taxes, sales taxes, property taxes, profit taxes, “sin” taxes, fuel taxes, and the many other fees and levies the government collects.

Of course, not all government revenues come from taxes – we’re also running a sizeable deficit, funded by borrowing. That’s why the Fraser Institute has also calculated a “Balanced Budget Tax Freedom Day.” This date is calculated by considering how much we’d each have to pay if the government funded all their current expenses without borrowing. Then we’d have to work all way to July 7 to pay off government expenses, and only then would we start earning for our own family. What that means is that the government is spending just over half of what Canadian families earn but they are lowering what we have to pay now by running up a debt that someone will have to pay off later.

This isn’t just saddling our children with our expenses: our growing debt is already impacting us now. The Fraser Institute estimates that the interest payments we have to make, when we combine the debt from every level of government, amounted to approximately $67 billion this last year. That’s somewhere in the range of what Canada’s K-12 schooling costs.

Because provincial debts vary greatly, the average “combined interest cost per person” varied greatly by province, with the low end being $1,059/person in BC, and the high being $2,604/person in Newfoundland. That’s a cost that comes each year again. This is why God talks about debt being like slavery (Prov. 22:7). The money we owe limits what we can do going forward.

We could view this past year’s deficit spending as, perhaps, understandable because of the unprecedented year it was. In our own households, if we were faced with a big enough emergency, we might raid our kid’s piggy banks and borrow from them. But before we excuse the federal government for overspending in 2020, consider how much they plan to continue overspending. Our pre-pandemic federal debt was $721 billion, and the government’s own expectations have that doubling by 2026.

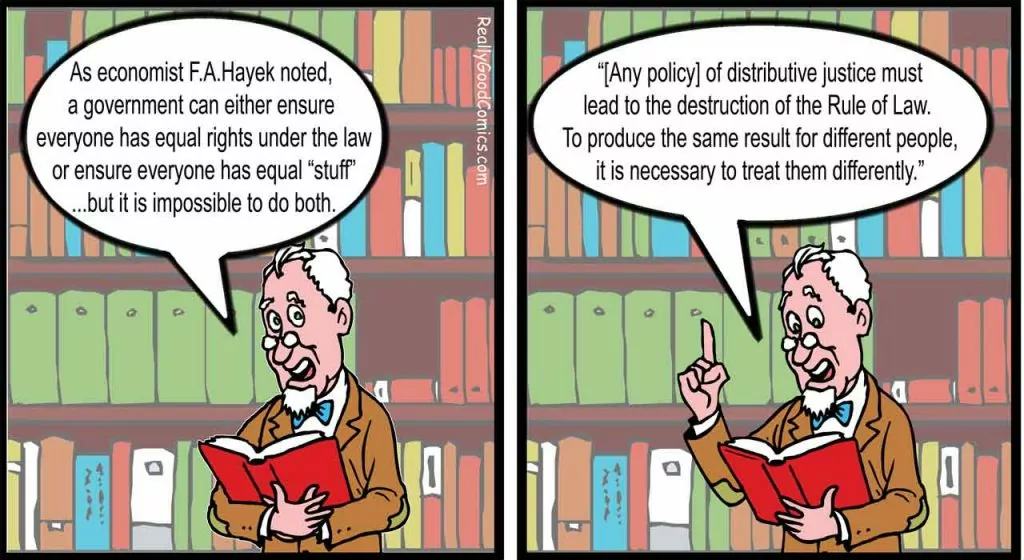

The problem here is not a revenue shortfall, but the sheer size of our government. In 1 Samuel 8:10-22 the prophet Samuel warns of the danger of a king because he might demand ten percent – he might in arrogance demand as much as God was! Well, this past year the average Canadian family had to pay a combined, all levels of government, tax bill of 39% of their earnings. And if we eliminated government borrowing and had to pay as we go, that same average family would have to contribute 51% of their income! We should take warning from Lord Acton here, not simply that “power tends to corrupt” but, with government grown to such enormous size, that “absolute power corrupts absolutely.”