Home ownership for Christians: how it happened in the past, and how it might now

As home prices have risen in most of Canada, young people may be wondering if they will ever be able to afford to own their own home

In BC’s Fraser Valley, and in the golden triangle of southern Ontario, prices have fallen recently, but a rise in interest rates have kept mortgage payments at a rate that are unaffordable for many. Is a house with a white picket fence to call one’s own an impossible dream today? How should Christians approach the concept of home ownership, and are there ways that we can be of service to one another in this important part of our lives?

I interviewed young couples, homeowners, renters, realtors, and others to get some insight into how Christians view real estate ownership, and to provide helpful advice for those who are wondering what the best course of action is for their family.

SOME BIBLICAL PRINCIPLES

We turn first to Scripture for some general principles on home and land ownership.

Psalm 24:1 says, “The earth is the Lord’s, and everything in it!” Christians know from God’s Word that all of creation belongs to our God: He made it all, and He owns every square inch. Because we acknowledge God’s ownership of every bit of creation, Christians view our “ownership” of a home, or a business differently. We acknowledge that the Lord calls us to be good stewards of what He has entrusted to us, and that He expects us to “be fruitful, to fill the earth, and subdue it” (Gen. 1:28).

The Lord gave wise laws through Moses that emphasized a family’s ownership of land. One who was in financial difficulty could lend his land to another, but this was not to be a permanent change in ownership: “The land shall not be sold in perpetuity, for the land is mine. For you are strangers and sojourners with me. And in all the land you shall allow a redemption of the land.” (Leviticus 25:23-24)

Further in Leviticus 25, Moses draws a distinction between agricultural land, and houses in “walled cities.” “If a man sells a dwelling house in a walled city, he may redeem it within a year of its sale. For a full year, he shall have the right of redemption. If it is not redeemed with a full year, then the house in the walled city shall belong in perpetuity to the buyer throughout his generations.” (vs. 29-30). Homes attached to farmland were treated differently; they did return to the family who originally owned them. Since many of us now live in “walled cities” – that is, we do not depend on the fruit of the land for our income – it makes sense that these two types of properties were treated differently.

More than 2,000 years later, we may look at the principles laid out in Scripture for guidance as we consider real estate and home ownership. We no longer live in God’s promised land, with guidelines for generational ownership, yet we observe that the Lord commanded His people to care for the land He entrusted to them, and that He blessed Israel as they did so faithfully, from generation to generation.

THE CANADIAN DREAM

Home ownership has long been part of the Canadian dream. For many in the Reformed community, our parents, grandparents, and great-grandparents emigrated from the Netherlands with the hope of better economic opportunities, and a desire to buy their own farm, homestead, or family home… which may have been out of reach in the old country. Then, as now, a house was a costly purchase, and required diligent saving for a down payment, and prudent money management to make the monthly mortgage payments.

Despite the challenges, most families in decades past found ways to get into home ownership, and by living below their means, and perhaps doing without some of the non-necessities, they were able to make their mortgage payments. It was not uncommon among our immigrant community for a couple to make do with one car for the family, and it was likely not a brand new vehicle but one that was purchased at least a few years old.

THEN VERSUS NOW

These condo apartments in the Niagara area went for $130,000 ten years ago, and are now listing for almost $400,000. And even as prices have recently dipped a little, that’s been countered by a rise in mortgage rates. (Photo: Danyse Van Dam)

We are accustomed these days to inexpensive electronic devices, and to Wi-Fi access throughout or homes. A generation or two ago, a television was a costly appliance, and many families did without these: having a screen for everyone in the house was not considered a necessity!

Another area that families did without was luxurious vacations. Although a trip to Mexico or Europe would be wonderful, many decided that camping at a lake, or making a road trip to cottage country would be a great way to make memories with their children.

From 2003 to 2018, prices for free-standing houses increased up to 330% in parts of Canada. Especially in greater Vancouver and southern Ontario, supply and demand drove prices up to levels that seem unimaginable to those who considered home expensive already decades ago.

Immigration to Canada from all over the world drove part of the demand side of this equation: in the last two years, more than 830,000 immigrants have moved into the Great White North, and many of these people have moved to areas that already had booming real estate prices. Construction costs for newly built homes have also ballooned. Higher wages for construction workers, increased costs for materials, and more and more red tape from local government all contributed to the costs that builders incurred, and passed on to new home buyers.

At the same time, the earning power of workers has grown exponentially. The average salary of a Canadian wage earner increased 2.45% each year the past twenty years, with large spikes in the past two years (including over 10% in 2020). This is slightly lower than the 3.8% overall inflation rate in Canada over the same time period, but not outrageously different.

WISDOM FROM GOD’S PEOPLE

Given all of the above, what wisdom can we offer a young Christian couple today? We all have different gifts and abilities; we live in different parts of the country, with different real estate pricing: what Scriptural principles can we apply to our lives today to honor the Lord in all aspects of life? I talked to several couples and families in different stages of their earthly journey, seeking wisdom for God’s people today.

Bert and Linda Vane are members of the Aldergrove Canadian Reformed Church in BC, and are parents of eleven children. Bert began his career as an entrepreneur in landscaping, employing many young people in landscape maintenance and new construction. As the Lord blessed them, the Vanes also invested in agricultural businesses, in real estate, and other opportunities. Bert believes that God gives all His creatures the obligation to work, and gives us stewardship of different pieces of life on earth.

“God grants us the right to ‘own’ a piece of His creation, to provide shelter and food for our families. He gives us the responsibility to provide for our families, and home ownership is a part of this calling.”

Bert believes without a doubt that ownership of one’s own house is a Godly desire, that ownership of property grants many blessings in the course of one’s life. These blessings include financial increase, but also add the stability granted to families when they are able to remain rooted in a location where they can be a dependable part of a church community.

MORTGAGE HELPERS

Since owning a home has become increasingly expensive, renting our primary residence has become another reasonable choice for Christians. Especially for young couples, needing only a one or two-bedroom home or suite in their first years of marriage, renting can be a wise decision for a period of time. This is most often not a wise choice for the long term (longer than 18 months), since ultimately costs for a rental unit are based on real estate prices, which change with time, and in the 21st century, mostly increase at or above the level of inflation.

When we were newly married, way back in the day, my wife Faith and I returned from our honeymoon to a one-bedroom suite in the basement of brother and sister-in-law, Ken and Christine VanderPloeg. I never thought to ask at the time, but I’m sure that our meager monthly rental payments were appreciated in Ken and Christine’s financial journey as they used that suite as a “mortgage helper,” and raised six children in that same home. We lived in that basement suite for a bit less than two years, when we were blessed to be able to buy our own home. It was also in Surrey, BC, and also contained a basement suite that was our own mortgage helper in the following years.

I can recall a few sleepless nights as Faith and I wondered whether or not it was the right thing to do, to buy our own home, especially as the purchase price seemed so impossibly high, more than ten times our annual earnings back in 1993. With good council from parents and in-laws, we went forward in faith, and bought our first home. We had enough funds for a good-sized down payment, thanks to my wife’s diligent savings, and we were able to borrow from family instead of the bank for the remainder, at a favorable interest rate. Later I learned that my parents-in-law, Henk and Jennie Schoen, had been able to offer similar assistance to all of their nine children, a result of their own stewardly financial management, and a generous spirit that was a blessing to all of us. Thanks Dad and Mom (since departed to glory)!

Readers may glean a few principles from the example above. First, living in less than ideal circumstances, with a suite as a mortgage helper, or a partnership arrangement of some kind, can be a great stepping stone to home ownership. And second, when parents or family are able to help financially or otherwise, they can be a huge blessing to a young couple that otherwise might not be able to afford a house of their own.

A FEW CURRENT EXAMPLES

Sean and Lauren Stel have been able to buy a house by doing so with Lauren’s brother Ben Ravensbergen.

Younger readers might be forgiven for scoffing at my own example of getting into the real estate market: “That’s well and good for you, old timer, but things have changed today! Prices are so high compared to your day!” That is certainly true: real estate prices are far higher today, but income levels are also much higher than past generations. Further, thriftiness as our parents and grandparents practiced, creative solutions like basement suites or partnerships, and tapping into the generous spirit of family and friends, are all still enormous opportunities today just as they were in previous generations.

Sean Stel is a software engineer working for L3Harris Wescam; he and his wife Lauren have two children. The Stels have been shopping for the right real estate deal for some time in the Smithville, Ontario area. Sean and Lauren brought Lauren’s brother Ben Ravensbergen into the buying process, and are together on the cusp of buying a home together. Ben works in construction, and hopes to be able to build a suite in the home for his own use. Sean and Lauren are very thankful for the opportunity to make this work, and hope to be able to live in their new home for many years. Sean shared the good advice that he received from family and friends: “Write down whatever you agree to, so that you don’t have any forgetfulness or misunderstanding down the road!” Especially as property values fluctuate, and as life circumstances change, this is indeed good counsel for anyone who buys a home with a partner.

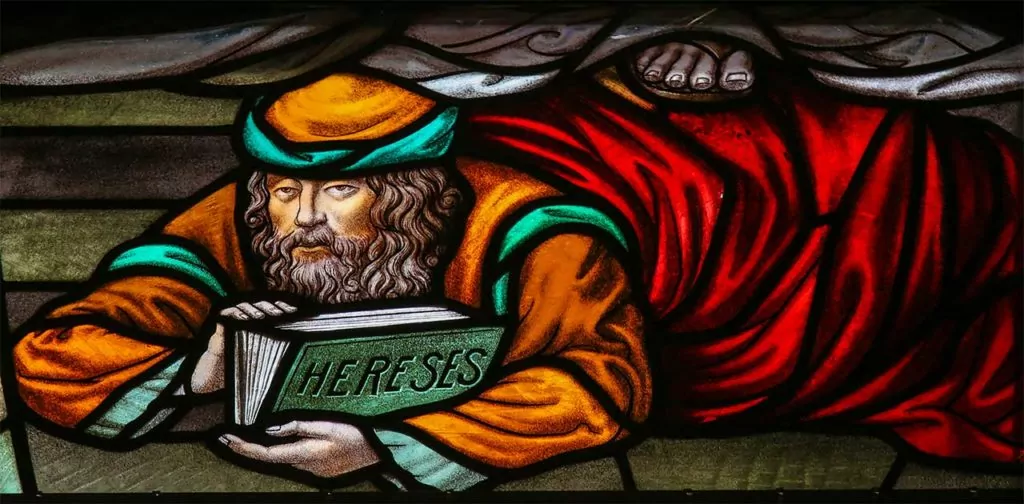

Ben and Meagan den Boer are Australian immigrants living in the Fraser Valley of BC. Ben is a teacher at Credo Christian High School, and Meagan, a former nurse in Australia, is a stay-at-home mom. Right now, the den Boers can’t see a way to buying a home in the Fraser Valley. With a teacher’s salary, with home prices as high as they are, and with most family connections being back home in Australia, it doesn’t seem to make sense for the young couple. The den Boers are very grateful for their current living space, as they rent a two-bedroom apartment (mortgage helper) at a reasonable rent. Meagan stated that none of her friends in BC have been able to buy a home yet at this point, and many are renting basement suites or apartments from family and acquaintances. Ben and Meagan do already own a home back in Australia, and are glad they did not sell it upon their move to Canada.

Ben and Meagan den Boer, along with their little guy Micaiah. Like many young couples in BC’s Fraser Valley, they haven’t found a home purchase that makes sense for them.

OWNING VERSUS RENTING

Tim Bratcher and Brian Bratcher are twin brothers, and immigrants to Canada from Pennsylvania. Tim and Brian were born and raised as members of the Blue Bell American Reformed Church; both brothers married Canadian spouses, and both ended up living in southern Ontario with their families. Brian and his wife Alicia bought a home in Dunnville about seven years ago. Although the purchase price was high compared to house prices in other parts of the U.S.A. or Canada where they could have moved, Brian and Alicia were able to borrow funds from relatives that made the purchase work. Seven years later, their home is worth more than double what they paid for it, and they have been able to put down roots in Dunnville.

Tim and his wife Amanda have not been able to make that same leap into the market, but have been able to rent a home that has worked for their family. Tim and Amanda moved out of Guelph to Welland, where rents are more affordable. Tim has strong opinions on real estate and landlords, and believes that a part of the increase in housing prices has been small investors who buy homes to rent them out. “I’d advise against buying a $500,000 home as a rental income property, if you know that you’ll have to charge at or above the current going rate. It just bumps that average higher, and each new unit will ‘snap’ to that new rate.”

HELP FOR THE NEXT GENERATION

Reformed Christians in 21st century Canada have been tremendously blessed in so many ways by our God. This includes incredible financial blessings! On average, “baby boomers” (born between 1946 and 1964) are considered the wealthiest people ever in the history of the world, and members of “Generation X” (born from 1965 to 1982) are not far behind, perhaps on a trajectory to surpass their parents in wealth. How might we use what God has entrusted to us for the good of God’s Kingdom?

God calls us to recognize His ownership of everything on earth: even while we think about “our” wealth, or “our” savings, we do well to remember that ultimately it is all the Lord’s. Might we be able to take part of our long-term savings or investments and have it be a blessing for our brothers and sisters, as well as for ourselves?

Here are a few ways that family can help younger people get into home ownership:

1. Celebrate the wedding, help with the house!

We’ve all seen wedding celebrations that become ostentatious displays, with lavish and unnecessary spending on things that mean very little in the long run. Are there ways that we as parents and grandparents and friends can encourage our children to appropriately celebrate their wedding with family and friends, while not digging a financial hole at the very start of their married life? When young couples are presented with the huge consequences of putting $15,000 towards the down payment on a house, and $10,000 towards a wedding celebration, versus $25,000 towards the wedding, we can help them make decisions that will be of huge benefit to them in the long term. (Hint: no one remembers what kind of napkins you had at your wedding, or what kind of food was served, but everyone remembers the speeches and the gezelligheid!)

2. Sharing our homes

Many of us still live in the homes in which we raised our families, and no longer need all the room that we have. Yet, it might not make economic sense for us to move because of the cost of moving, or we might just enjoy the home in which we live. Could we find a way to accommodate our married children in our homes for a few years while they get established? This may be for a few months; it may be for a few years, but however it is accomplished, it can be a huge savings for a young family.

3. Lending funds at a low interest rate, or co-signing a loan

With mortgage rates much higher than they were three years ago, interest has become a much larger component of buyers’ monthly payments. Could you lend your relatives or friends some of your savings at a lower rate than the bank would lend to them? Or could you lend them a portion of the down payment at low or no interest?

Co-signing a loan, while potentially risky for the co-signer, is also an avenue to helping a young couple to establish credibility with a bank. (Co-signers need to be aware that they are responsible for continued payments on loans, even when things get messy!)

4. Lending funds as a shared investment

Many economists believe that real estate prices in Canada will continue to rise well above the rate of inflation. For your long-term savings, could you find a way to invest in real estate with your children or grandchildren, providing part of the capital required in exchange for a percentage of the increase in value?

This concept requires careful documentation so that all parties are aware of how increases or losses in value are shared, but may be a good investment for the older generation, as well as a huge helper for the younger generation.

CONCLUSION

From the examples above, and from our own experience, we can observe that home ownership has been an enormous blessing for generations of Canadian Christians. In the long term, owning one’s own home is foundational to financial stability and good stewardship of the resources the Lord has entrusted to us. May the Lord give wisdom to young couples considering how they may become homeowners, and may He give a spirit of generosity to older generations wishing to help their children and grandchildren in this good and Godly goal....