As dusk was settling in on a foggy November day in BC’s Bulkley Valley, I parked my car on the driveway next to the home of Matt and Montana Slaa. String lights were glowing around their home, which overlooked a rolling field, and also came equipped with a stunning view of two mountain ranges. It wasn’t hard to find the entrance, as there was only one door. Matt and Montana, along with their daughter Gabriella, welcomed me into their tiny home.

I had to be careful where to put my shoes, as there was no boot room or entryway, and I had a hard time reaching the hanger for my coat as it was about 8’ high. But it only took a few seconds to feel an overwhelming sense of coziness and tranquility, radiated by the character of both the home and my hosts.

In an age where it has become a momentous challenge for young men and women to get into the housing market, I visited with Matt and Montana to discover whether their outside-the-box solution of living in a tiny home with children is a practical solution that others may want to consider, or more of a romantic notion than a practical one.

When dreams and practicality unite

With marriage, God joins two people into one. For Matt and Montana, that happened in the summer of 2020. Montana grew up in Smithers, the daughter of a school teacher and an artist. Matt’s family moved into the area as his father is a pastor who accepted a call to serve in a local Reformed church.

“I always wanted to live in a cabin,” shared Montana. “It was right from when I was young. That was my dream.”

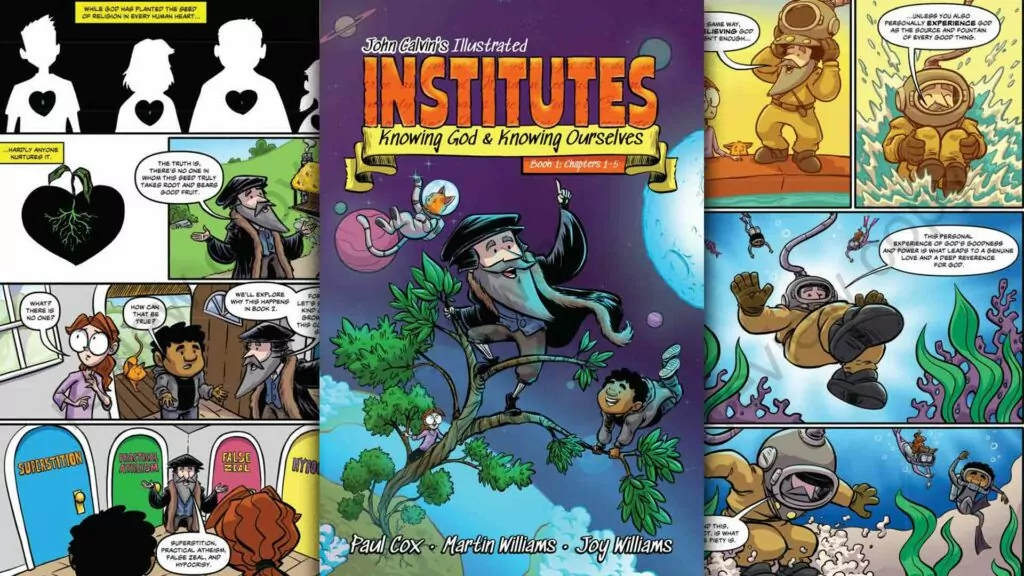

The happy couple as they move in…

Matt was in university while they were dating, preparing to become a teacher. They wanted to get married, but how were they going to afford that? “I felt like I had to come with a financial plan for Montana and her dad,” Matt explained. The problem was that he still had to do more studies to get his education degree to become a teacher. That itself would come with a big cost, as they were planning to move away and study for a year in PEI.

They proceeded to estimate the cost of building a tiny home, using the money they had saved. They had a year and a half to plan the project, using software from SketchUp to design it around the materials they collected.

“We did it very cheaply,” explained Matt. “Wood and windows we collected from someone who was getting rid of them for free.”

At this point in the conversation, Montana kindly offered me a cup of tea. Since a coffee table doesn’t fit in the room, she pulled out a tall block of wood, which they use not only as a coffee table but also a dinner table (when it is laid down on its side), and a stool for their daughter to stand on when helping with the dishes.

I learned that the Slaas didn’t experience tiny home living prior to jumping in with both feet. Most of their inspiration came from online research and books, but they “just learned along the way.” At one point they decided “we’ve seen what we want to see. So we stopped looking at ideas, and worked with what we had liked, to come up with our own plan.”

They purchased a 20’ trailer to go under the home for about $5,000, and built the home 22’ long and 10.5’ wide. That is about the maximum width to still be road legal if it was ever to be moved. Since both Matt and Montana are tall, they didn’t bother with a loft but kept the ceiling vaulted, with a curved ceiling over their bed. Their bed is raised, with a lot of storage underneath, and space too for Gabriella to enjoy some quiet time. Windows dominate two of the walls, to take in the views of fields and mountains.

Freedom from debt and materialism

Spending more time outside was part of the appeal for the couple. The small quarters force them to get outside for more space. A highlight of each morning involves Montana taking Gabriella out to the chickens, which currently live in a greenhouse for the winter, to collect the eggs.

I asked them what else inspired them about tiny house living. For Matt, a big motivation was the freedom that comes from building his own place and living mortgage-free. “That is what came first.” But he was quick to see that it provided so much more, including spending a lot of time together.

“So many people, when we talk about tiny homes are like, ‘we can never live that close.’ But we love it.”

The couple acknowledged that they aren’t naturally bent towards a minimalist lifestyle. But this home forces them to do with less. “We always say you fill the space that you have,” Matt said. “So every few months, we have to do a purge through all our storage space.”

“There’s so many things that you don’t really need because you [already] have something that works,” added Montana. “Just the other night we were talking about how we don’t have an electric mixer, even a handheld one. It’s going to be another thing that we have to put somewhere. I have one whisk and I use it for everything. We make whipping cream all the time.”

They originally didn’t think they needed a toaster either, but decided that toasting their bread over the fire wasn’t a sustainable option.

“We just learned to really love the idea that we can do it with less,” said Matt. “And then there’s the financial benefit of that too. We started to save a lot of money.”

Matt contrasted this with the year they spent in PEI, where they lived in a larger home that was 600 or 800 square feet.

“We saw an espresso machine for sale, it’s like, ‘oh, you should get that.’ And we loved it. But there were so many things that were like, ‘oh, we should get that’ or ‘we should do that.’ Just because it was possible. Before you know it, we had spent quite a lot of money doing all these things. And we had to sell a lot of it when we left, so that we can fit back into this.”

Building from scratch

Tiny homes have become popular, and it isn’t hard to buy them new or used throughout the world. I asked Matt if he had experience building homes before tackling this project. He always loved creating things as he grew up, and did some woodworking. But for the most part, he figured it out as he went and thinks most people can do the same. “I’m convinced that given enough time, and commitment to learning, you can do it.” That even included the wiring, though not without getting shocked once.

Northern BC gets cold over the winter, and the Slaas’ walls are framed only with 2×4 lumber. Yet the home stays plenty warm thanks to a tiny wood stove. The stove requires very small pieces of wood, so they use less than a cord of wood each year. (A cord is 4’ wide by 4’ tall by 8’ long – equivalent to a pickup truck load piled high.) This is about 20 percent of what most homes in the area use. And the stove plays an important role in keeping the home dry, which can be a challenge for a small space with a few people breathing, cooking, and showering in it.

Because the fire burns out after about four hours, the Slaas sometimes wake up to a cool home (about 12 ºC). But it warms up quickly again when a new fire is lit in the morning.

Matt showed me their bathroom, complete with a compostable toilet. A small bin of wood shavings paper sits next to the toilet, to assist with the composting. I don’t notice any smell (an improvement over many bathrooms with flush toilets). They also have an on-demand hot water system for their shower, but the water has to be collected in a bucket so the showers aren’t long.

Their total cost to build the home was about $15,000. That includes the trailer under it, the wood stove, and the propane water heater, which were the more expensive components.

Prioritizing family

With another baby due in the new year, the couple has started building a second unit, with about the same dimensions, next to this home. The plan is to connect the two dwellings with an indoor walkway – a four foot-wide hallway which will also be their new main entrance/ boot room. The added space will make it much easier to put the children to bed without worrying about waking them up, and Matt and Montana are also looking forward to an eating area. The new quarters won’t be built on a trailer, but this new unit can still be loaded onto a trailer if it needs to move in the future.

A little help in the kitchen can always be had.

The Slaas are realistic that this setup is not going to be too long-term, because they hope to have a big family, the Lord willing. That

is why they are building the addition as a separate structure. “The idea is that, very easily, we can pull it apart. And it will be its own tiny home unit,” Matt explained. “We could sell it, or Airbnb it, or rent,” added Montana.

“But we are determined to make it work as long as we literally possibly can. And even after that, we are quite keen to explore other options,” shared Matt. “I’ve looked at yurts that are almost 1,000 square feet. And they’re $40,000 to $50,000. Why not?”

I asked Montana what it is like to be a mom in a tiny home.

“There’s definitely things that you just do differently,” she explained.

“Like sometimes I think, oh, it’d be really nice if I could get up more easily without [Gabriella] waking up in the morning. So most of the time, I would just stay in bed with her until she wakes up because I don’t want to disturb her. [If] I get up, I sneak out of bed and then sit here, in the dark, so that she can keep sleeping, and I quietly just read and do really quiet things….

“As soon as you have kids, it is not about you. It’s a sacrifice that you make. And it’s a really good one….

“But then we just do our morning routine and eat breakfast together and then we try to get out of the house and go outside and do the chickens in the morning and that breaks up the morning for Gabriella. And she does get a little bit cranky in the morning. I think sometimes she just gets kind of bored.”

Gabriella doesn’t get the boatload of toys that many other children experience, even in homes with less means. She plays with kitchen utensils and the kindling for the fires, in much the same way that kids play when their parents are camping.

“So we’ve been really trying to teach her that it’s okay to play or read a book by herself.”

Gabriella also ends up doing a lot with Montana. “She’ll stand at the counter on the stool with me while I make dinner or do the dishes, she loves to help with the dishes. She wants to do what I’m doing. And I think that it’s a big difference to having a house with more rooms.”

Montana admits that some things just don’t work in the tiny home, including her passion for painting. That’s hard to do with a little one in close quarters, so Gabriella will often go up to her oma’s house for an afternoon, which is on the same property.

Hospitality can also be a challenge. “Generally, if we have people over, it’s for coffee. Maybe a cup of tea and chat for a couple hours,” explained Matt. It doesn’t work well to have people over for a meal unless they can eat outside, which is seasonal and weather-dependent.

Saving to buy dirt

A look inside, with bed in the back, play nook underneath, and the wood burning stove to the left.

They are also transparent that this is not meant to be an alternative to getting into the real estate market, but a step towards it. “This allows us to dream of and hope for a future in buying real estate, because we do hope to have our own property, hopefully with a good bit of land, that we can farm and garden and have lots of animals,” Matt shared.

Because they live on someone else’s property, tiny home living allows them to save a lot of money. Some time ago they put a note on Church Social (a congregational app) to see if anyone would be up for having them park their home on their property, and were amazed that four or five families were willing.

Their monthly costs for utilities total about $100, so they are able to save $20,000-$30,000 a year towards buying their own land, which they hope to do in about five years.

“This lifestyle allowed us to go to PEI to go to school for entire year, not even working, and to be loan free and to come out so much further ahead than we could have,” shared Matt. “So financially, it’s a no-brainer.”

“If we had a $400,000 home we’d be struggling to buy groceries. That doesn’t sound at all better than where we’re at now.” Matt later added that because of this arrangement “we’ve never had any financial stress whatsoever.”

This is far less expensive than renting. Most Canadian communities, including Smithers, have seen rental rates skyrocket to between $1000 and $2000 per month for a modest unit with one or two bedrooms.

Matt noted the contrast: “If you live in your tiny house for a year and a half, it’s paid off.”

He also respectfully disagrees with those who challenge them that a tiny home won’t increase in value. “If you build it yourself, you can almost always sell it for what you spent on it if you’re smart with it. And likely more. And you have an option of renting it out.”

Matt emphasized the importance of keeping the costs down by working with what is available rather than insisting on a particular design. “We’re not set on what’s on our walls or whatever we’re going to put on our ceiling. Something might come up that will work good for us.”

“The fact that we built it ourselves makes a big difference too. We built it while we were engaged and it’s kind of part of our marriage story, our love story. I think if you just bought a tiny house for $100,000 you wouldn’t be that attached to it or invested in wanting to stay in it.”

Matt explained that because tiny homes are built on a trailer, they aren’t subject to the rules that governments have about building structures on a property. It is similar to an RV being parked on a property.

Contentment personified

As I left their home and drove to mine, one word was impressed on me: contentment. In 1 Timothy 6: 6-8 we read that:

“godliness with contentment is great gain, for we brought nothing into the world, and we cannot take anything out of the world. But if we have food and clothing, with these we will be content.”

I also can’t help but be convicted at how much effort we put into pursuing possessions, caring for them, storing them, and then getting rid of them. Instead of giving us contentment, they so often choke us like thorns among the wheat (Matt. 13:22).

“In a sense, we feel very wealthy,” Matt reflected. “We have so much more than what so many people have. And we’re so thankful for how the Lord has directed us along this path and taught us to love it.”

Pictures are thanks to the Slaas. For bigger pictures, read this article as it is featured in the Jan/Feb 2024 issue.