If you’re wondering if you can afford a home, this would be a good time to look carefully at your monthly expenditures. Christians are called to be wise stewards of what God has entrusted to us, and He has blessed us with so much! Yet if we are not careful, we can so easily fritter away our funds, and end up not being able to take care of obligations or move ahead with good goals like home ownership.

In Luke 14, Jesus gave a parable about the cost of being one of his disciples, and used the analogy of a builder considering his expenditures before tackling a project: “For which of you, desiring to build a tower, does not first sit down and count the cost, whether he has enough to complete it?”

Don’t just think about it

A tool to help in deciding whether or not one can afford a home is a monthly budget. Most people hate budgeting; it can be such a tedious task! But it is also an excellent discipline that will make an enormous impact on your ability to manage your income and expenses, and over time will result in you being able to be even more generous to charitable causes, and to help others along your path.

How do you start? Like any journey, it always begins with the first step. Take a notebook, or open a new spreadsheet, and for 60 days, write down and categorize every time you spend money. You can download your banking transactions into financial software as a shortcut, but it is more effective the “old fashioned” way – making you more conscious of your spending patterns.

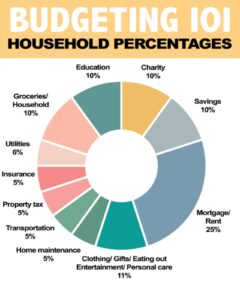

Categorize your spending into different categories as follows: charity, savings, groceries, mortgage or rent, insurance, home maintenance, education, property taxes, entertainment, dining out, utilities, transportation, clothing, medical/health, and personal care. After 60 days of tracking your expenses, you’ll have a pretty good idea of where your money is going, and you can set goals in these categories that will help you decrease your spending where it is not important, and increase your savings.

A sample budget

This graph shows what a typical household might set as goals for spending in these different categories (these may be quite different for you depending on where you live, and your stage of life):

- Charity: 10% (Make this your first expenditure, not your last!)

- Savings: 10%

- Mortgage/Rent: 25%

- Education: 10% (Depends greatly on what stage of life you are at!)

- Groceries/household: 10%

- Utilities: 6%

- Insurance monthly: 5%

- Property tax monthly: 5%

- Transportation / gas / savings for repairs: 5%

- Home maintenance / savings for maintenance: 5%

- Clothing: 2%

- Personal care: 2%

- Medical / Dental / Health: 2%

- Gifts: 1%

- Entertainment / Recreation: 1%

- Eating away from home: 1%

Many financial planners recommend that you not take on a mortgage that would result in more than 30% of your monthly expenditures going to your home (including property tax, home insurance, and monthly payments). As you develop your own budget, you’ll be able to see if that “rule of thumb” works for you.

The “Freedom Fund”

Sometimes our budgets go astray when we have bills for an unplanned car repair, or when our annual home insurance premium comes due. Financial planners have recommended a concept called the “Freedom Fund,” and it can be a huge help. For expenses that are regular and planned (like an insurance bill, or property taxes), one can divide the total expected expense in 12, and then set aside that amount every month into a dedicated savings account.

For expenses that are not regular, but that we can expect will come up, like a car repair bill, or major appliance replacement, one can set aside a reasonable amount (as low as $50 per month, or as high as you might think prudent) into another savings account. (Many banks and credit unions allow members to create “sub accounts” connected to their savings account, and even allow you to name them online!)

These savings accounts, labeled for their intended purpose (like “Car Repair” or “Home Repair” or “Insurance”), become your “Freedom Funds,” so named because they can free you of the stress of sudden bills or non regular expenses. It’s a really simple concept, but if you follow the suggestion, you will find yourself in better control of your finances!

Cash is the answer!

One more incredibly effective way to stretch your money further is to begin paying for most of your purchases with cash. Yes, it’s old-fashioned; no, it’s not as convenient as plastic, but you may be absolutely certain that you will spend less, and will be better able to stick to your budget, if you change to cash as your payment system for every one of the categories that you can do so.

At the beginning of each week, or perhaps after each paycheck, take out cash for each category for which you are responsible. (You can use envelopes to differentiate each category, or you can buy an organizer wallet that has three or four different compartments.) When the funds for a category are empty, that’s it for spending for that period!

People laugh when they hear this suggestion – it’s so simple – how can it work? But it really does have a powerful effect on overall spending. There’s something about having to take cash out of a wallet that is more of a deliberate spending choice than simply swiping or inserting a credit or debit card. Try it! You have nothing to lose except a little bit of convenience.